The second part of our three-part Cooling as a Service series talks about the CaaS market in Canada.

COOLING AS A SERVICE: IS CANADA READY?

With cooling demand expected to triple by 2050 and increase to 30 percent of global electricity consumption, global markets and populations will face increasing pressure to find more efficient, sustainable and long-term cooling solutions. Further, the climate impacts of cooling are immense with both emissions from energy usage and high global warming potential (GWP) refrigerants contributing significantly to the global climate crisis. It is estimated that a coordinated global effort towards energy-efficient cooling could avoid up to 460 billion tonnes of greenhouse gas emissions over the next 40 years. Cooling as a Service (CaaS) is one of the ways we can address the growing cooling demand and the need for more energy efficient solutions. In this three-part series, Queen’s University Engineering grad Julian Burger talks about how this model was conceived, how it works and the potential benefits of using it in North America and beyond.

COOLING AS A SERVICE MARKET OVERVIEW

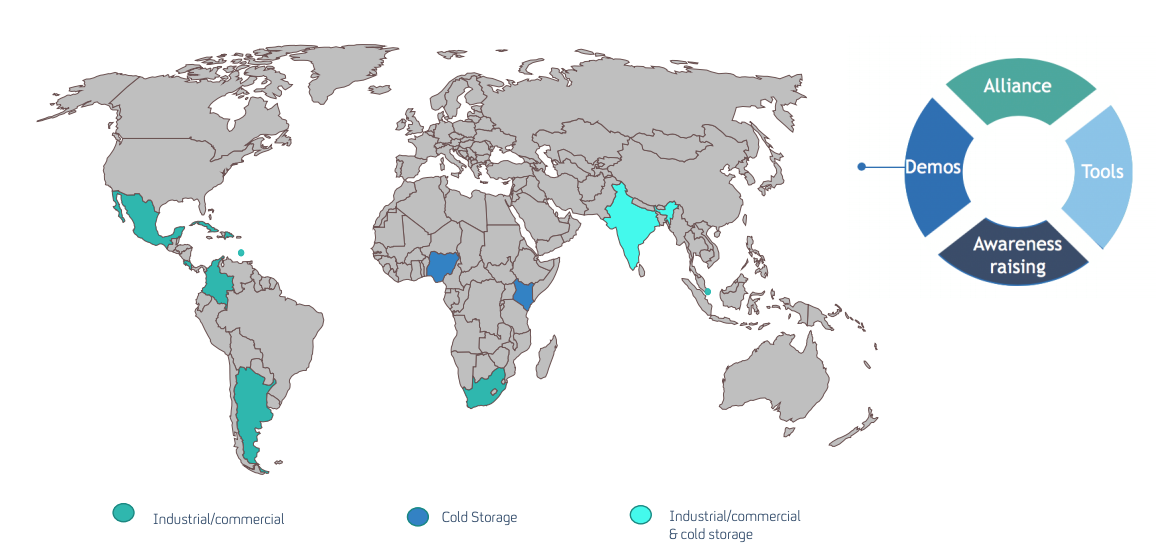

Cooling as a Service is currently in its early developments and is in a piloting phase in order to demonstrate the efficiency of the model, publish success stories and results, and help spread awareness globally. The Global Innovation Lab for Climate Finance (The Lab), a public-private initiative which works to launch new sustainable investment ideas analyzed CaaS as part of its 2019 endorsement of the model. In its analysis, The Lab identified four key criteria for determining the ideal target countries for CaaS piloting which are: international engagement, domestic planning, local energy prices and impact, and cooling supply and demand. Based on these categories, The Lab selected ten target countries: Mexico, Brazil, Malaysia, China, Thailand, Nigeria, South Africa, Senegal, Ghana and Bangladesh. Pilot, or “demo” projects for CaaS have now been deployed in twelve countries across three sectors as seen below.

Figure 1: Current Demo CaaS Projects Worldwide (BASE, K-CEP)

These demo projects are the first implementations of CaaS and are currently being used by the CaaS Initiative as case studies to spark further adoption of the model worldwide. From a large-scale residential air-conditioning system in Colombia, to cooling systems for a data center in Singapore, CaaS has shown its versatility across multiple sectors within the cooling space.

Within each of these pilot projects, the CaaS Initiative has partnered with a refrigeration company (most often from the country within the project is taking place) and a financing partner to establish a contract. The majority of projects have only been in operation since 2018 or later with some projects predating the establishment of the CaaS Initiative.

WHY HASN’T CAAS BEEN IMPLEMENTED IN CANADA?

As CaaS is such a new model for cooling, the pilot projects that have emerged have been directly supported by the CaaS Initiative in the planning and execution of contracts. The CaaS Initiative has developed financial models, sample contracts and other resources to help companies looking to provide CaaS solutions and have worked alongside refrigeration companies and clients to aid in establishing the early success of the model.

Due to the philanthropic nature of funding that the non-profits spearheading the CaaS Alliance receive, they have geographical limitations on where they can directly support CaaS projects. BASE may only directly help with the implementation of CaaS in countries that are eligible for official development assistance (ODA), as outlined by their status as partners with the United Nations. As such, developed countries such as Canada and the United States have not benefited from the direct support of the CaaS Initiative and as such have yet to see CaaS implemented. Additionally, developing countries are projected to see significantly higher cooling demand increases than Canada over the next 30 years. It is therefore crucial that energy-efficient models like CaaS are adopted within these countries first to ensure that access to affordable and sustainable cooling is met where it will be most needed.

However, this has not diminished the interest or prospect for CaaS in North America or Europe with refrigeration companies expressing interest to the CaaS Initiative in receiving more indirect support through joining their global CaaS Alliance. BASE sees a very high potential for success in Canada due to the more adaptable and open market than in developing countries. Canadian financers and cooling providers alike will look to see continued success of early CaaS projects abroad and more case studies published to ensure a firm understanding of the model and its benefits before pursuing pilot projects of their own.

WHAT ARE THE BARRIERS TO ENTRY FOR CAAS IN CANADA?

In addition to CaaS being in its early implementation stages, there are also other barriers to entry that must be examined and mitigated in order for it to enter Canada. When examining the challenges that CaaS faces, The Lab outlined three key barriers to entry for CaaS.

The first barrier is the sourcing of capable implementation partners. This means not only cooling providers looking to offer CaaS but also finding the right customers and finance providers that will be willing to be early adopters of the model. This barrier can be mitigated by focusing on customers and finance providers that have a history of sustainability as well as innovation. Partners who are ready to adapt and see value in the sustainable benefits from a CaaS project, alongside the financial and operational benefits, are more likely to be early adopters. BASE believes that as these kinds of partners take on more and more CaaS projects, other companies with less of a profile for innovation will see the success and be ready to use the model as well.

Second, cooling providers will have to be willing to make changes internally in their business processes in the switch from being a seller of cooling systems to a service provider. This may mean changing metrics to measure success away from reporting purely on sales and changing the overall strategy of the cooling company. This barrier may be challenging especially for larger cooling companies that have set systems and operations in place and may take longer adapt towards servitization. The Lab believes that this internal shift for cooling companies can be mitigated through support from the CaaS Initiative in resources such as financial models, structuring guidance, contracts and the use of the CaaS Alliance network for sharing of key learnings and best practices.

The third potential barrier to entry for CaaS is working in markets that have harsh enabling environments. Examples of this could include low availability for capital and high customer default rates. These barriers are less of a worry in a market like Canada which is more liquid than the markets in which demo CaaS projects have been taking place, and as such, would be less of an issue for Canadian implementation. The Lab also identified high/fluctuating electricity prices as a potential barrier; in the CaaS model, the price of electricity dictates the monthly fee charged to a customer, and as such, contracts should accommodate for potential fluctuations or increases in electricity.

WHAT DOES EARLY ADOPTION OF CAAS IN CANADA LOOK LIKE?

Based on the current CaaS market and overcoming the barriers to entry, there are a variety of possible early CaaS adopters that could establish the Canadian market in the next five to ten years. The primary sector which would most likely see early implementation is medium to larger scale industrial refrigeration solutions. This is due to the fact that larger projects see the highest gains in terms of cost savings and emissions reductions, and to date, the industrial sector is the most tested within existing demo CaaS projects.

While smaller companies would highly benefit from the avoidance of capital expenditure, they also face higher risk of defaults and as such could be less desirable as first adopters for cooling providers and financers looking to take on 10 plus year-long contracts. Additionally, larger companies would have a greater benefit from the reduced operational oversight of a CaaS project and the ability to optimize and focus on their already existing operations. Larger multinational companies such as Dr. Oetker, which is currently undergoing a CaaS project in South Africa, could also be inclined to continue using the model in other operations such as in Canada. It is likely that companies who have existing relationships with cooling providers and are looking to either invest in a new facility, or retrofit an existing one, would be interested in using a CaaS model. Larger companies have also started establishing stricter sustainability measures, with carbon neutrality becoming a more and more popular target; a CaaS project could help in demonstrating a commitment to energy efficiency and reduction.

In conclusion, it is likely that the first adopters of CaaS in Canada would be medium to large sized companies looking to reap the financial, operational and environmental benefits of a servitized cooling solution. Companies which fit the size criteria, already possess existing and aging cooling systems, demonstrate innovation, and have a desire for CSR activity, would be the ideal and most likely target CaaS customers. Other potential markets to grow into such as cold storage, residential and commercial as well as targeting smaller clients, are all viable for CaaS and would likely follow if success in the industrial sector can be demonstrated.

Read the first installment in this series: Cooling as a Service, a New Business Model for Sustainable Refrigeration.

Related Posts

CIMCO Expands Large-Scale Heat Pump Offerings Through Everllence Partnership

DesLaurier Cold Storage

Bayshore Community Center

|

|